38 coupon rate formula calculator

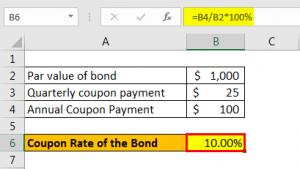

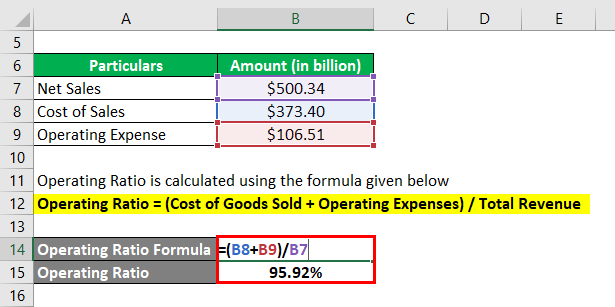

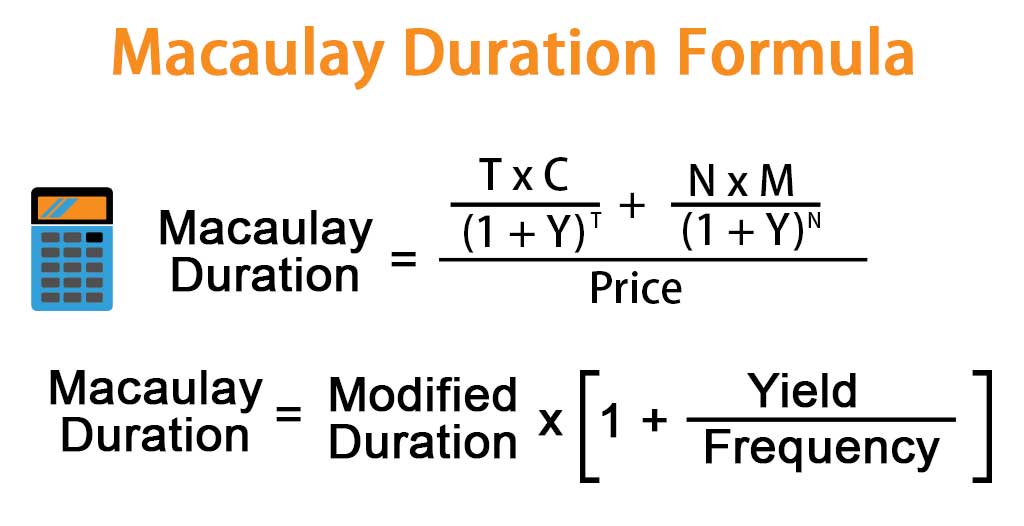

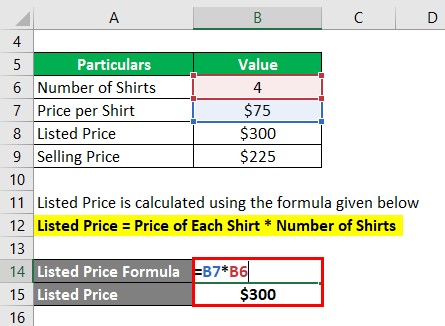

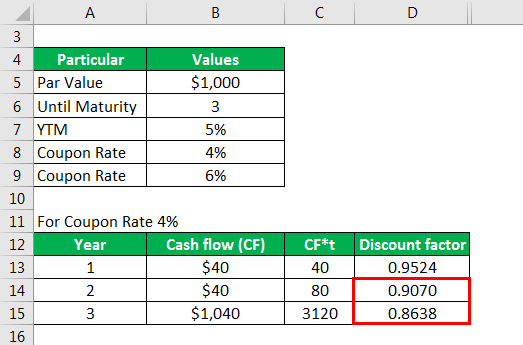

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon rate formula calculator

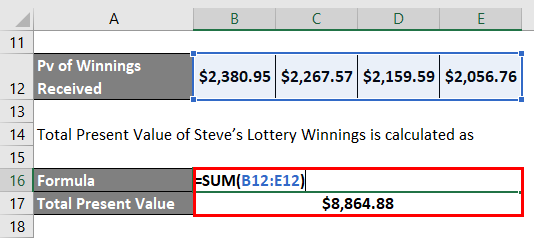

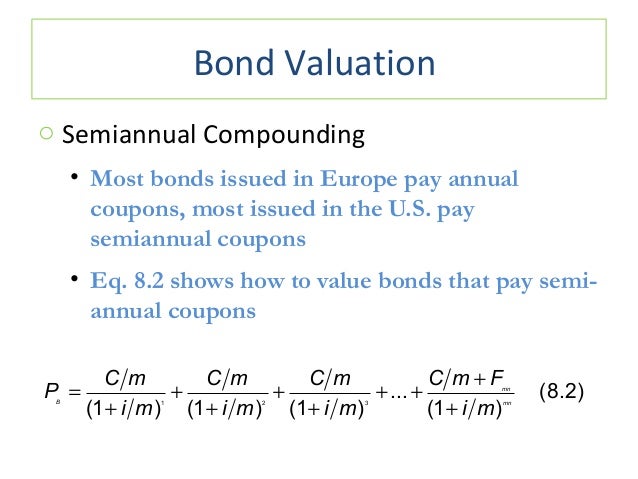

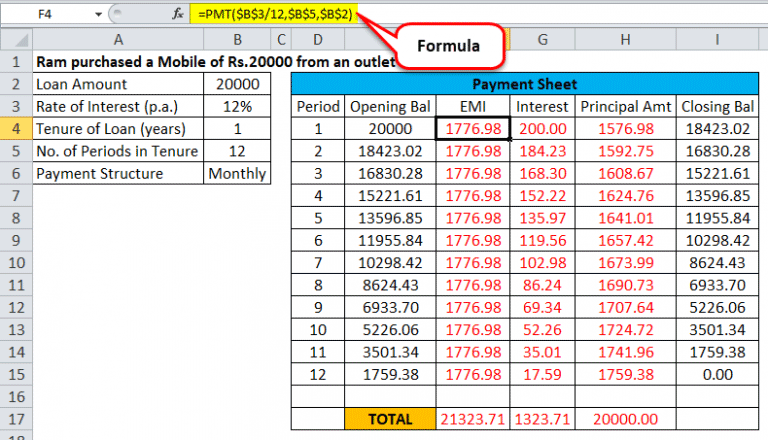

Coupon Payment | Definition, Formula, Calculator & Example Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. Coupon Rate - Meaning, Example, Types - eFinanceManagement A typical coupon rate formula would be - Coupon Rate = Reference Rate + Quoted Margin. The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

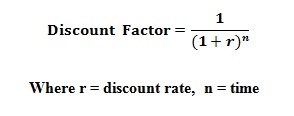

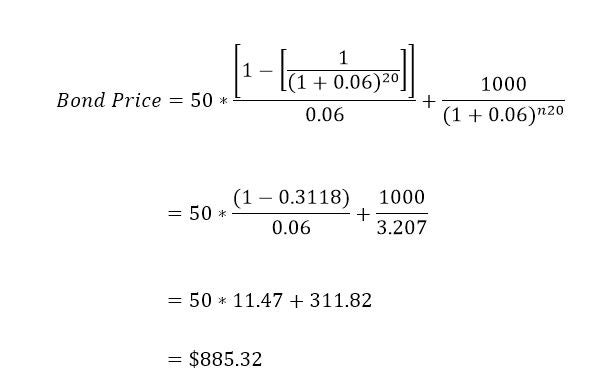

Coupon rate formula calculator. Yield to Maturity Calculator | Good Calculators The calculator uses the following formula to calculate the current yield of a bond: CY = C / P * 100, or CY = (B * CR / 100) / P. Where: CY is the current yield, C is the periodic coupon payment, P is the price of a bond, B is the par value or face value of a bond, CR is the coupon rate. Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate. Where: C = Coupon rate. i = Annualized interest. P = Par value, or principal amount, of the bond . Download the Free Template. Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond.

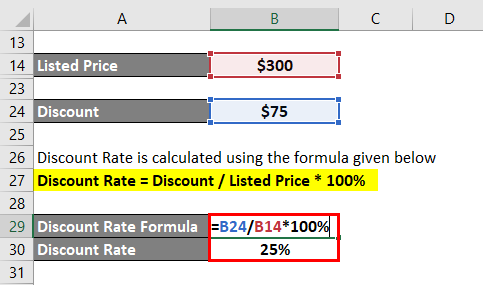

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ... Free Excel Template Download - Corporate Finance Institute Coupon Rate Formula. The formula for calculating the coupon rate is as follows: Where: C = Coupon rate. I = Annualized interest. P = Par value, or principal amount, of the bond . More Free Templates. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document ... Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Coupon Rate - Meaning, Example, Types - eFinanceManagement A typical coupon rate formula would be - Coupon Rate = Reference Rate + Quoted Margin. The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Payment | Definition, Formula, Calculator & Example Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

Post a Comment for "38 coupon rate formula calculator"