41 consider a zero coupon bond with 20 years to maturity

Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Investments Final Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Bond Price Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today., YTM- Zero Coupon Bond A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Calculate ...

6.2.2 Flashcards | Quizlet A risk-free, zero-coupon bond with a $5000 face value has 15 years to maturity. The bond currently trades at $3750 . What is the yield to maturity of this bond? A) 1.936 % B) 0.968 % ... Consider a zero-coupon bond with $100 face value and 15 years to maturity. If the YTM is 7.4%, this bond will trade at a price closest to _____. A) $41.13

Consider a zero coupon bond with 20 years to maturity

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Solved Consider a zero coupon bond with 20 years to - Chegg This problem has been solved! See the answer Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to Expert Answer 100% (3 ratings) Assuming face value to be $1,000 Price at 7% = FV / (1 + r)n Price at 7% … View the full answer

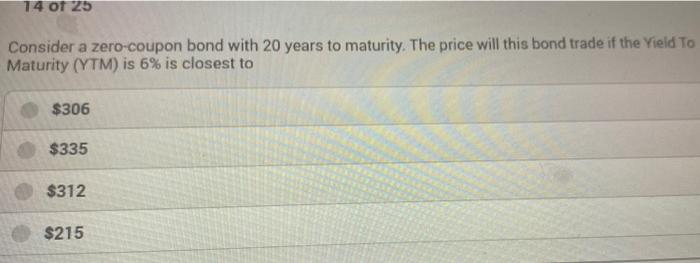

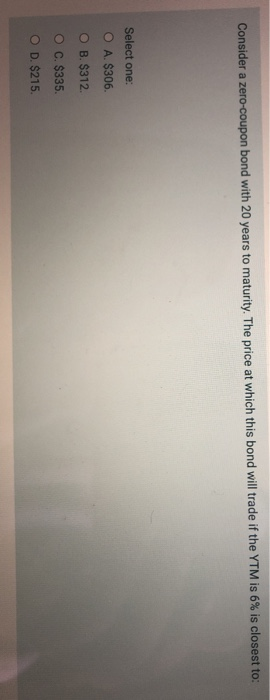

Consider a zero coupon bond with 20 years to maturity. Question 21 consider a zero coupon bond with 20 years - Course Hero QUESTION 21 Consider a zero-coupon bond with 20 years to maturity. The price this bond will trade at ifthe YTM is 6% is closest to: $215 $312 $335 $306 Bond value 1000 1+0.06^20 Bond value 1000 3.207135472 Bond value $ 312 QUESTION 22 An investor purchases a 30-year, zero-coupon bond with a face value of $1000 and a yield to maturity of 6.5%. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Consider a zero coupon bond with 20 years to maturity Consider a zero- coupon bond with 20 years to maturity . The price will this bond trade if the YTM is 6 % is closest to ______________ _ _. Hint : Assume par value is $ 1000 , annual compounding . A . $ 215 B. $ 312 C. $ 335 D. $ 306 14 . Consider a zero- coupon bond with a $ 1000 face value and 10 years left until maturity . Consider a zero coupon bond with 20 years to maturity BUSI 408 Consider a zero coupon bond with 20 years to maturity The amount that the price Consider a zero coupon bond with 20 years to maturity School University of North Carolina, Chapel Hill Course Title BUSI 408 Uploaded By MinisterFinch2452 Pages 7 This preview shows page 5 - 7 out of 7 pages. View full document See Page 1

Solved Consider a zero coupon bond with 20 years to - Chegg See the answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer Previous question Next question Consider a zero coupon bond with 1000 face value and - Course Hero Consider a zero coupon bond with 1000 face value and 20 years to maturity The Consider a zero coupon bond with 1000 face value and School California State University, Fullerton Course Title FIN MISC Uploaded By rubycloct Pages 16 Ratings 96% (324) This preview shows page 5 - 8 out of 16 pages. View full document See Page 1 Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity School University of Winnipeg Course Title BUSINESS Finance Uploaded By Basan_22 Pages 34 Ratings 98% (131) This preview shows page 14 - 18 out of 34 pages. View full document See Page 1 16) Consider a zero coupon bond with 20 years to maturity. Financial Management Exam 3 Flashcards | Quizlet Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is. $311.80. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is. 371.80.

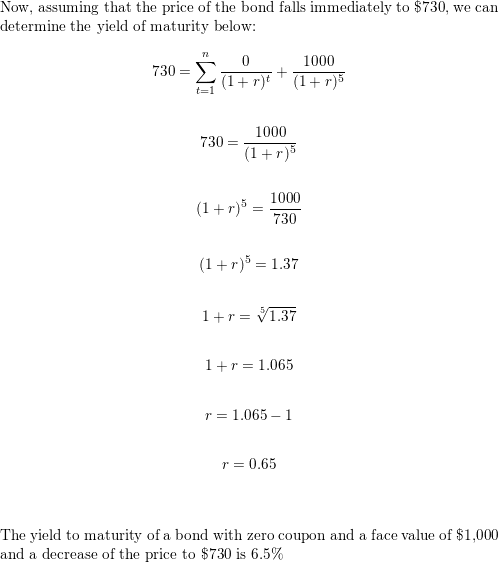

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ... Principles of Investments- Chapter 10 Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin...

When is a bond's coupon rate and yield to maturity the same? - Investopedia A bond with a $1,000 par value and coupon rate of 5% pays $50 in interest each year until maturity. Suppose you purchase an IBM Corp . bond with a $1,000 face value, and it is issued with semi ...

Solved Consider a zero-coupon bond with 20 years to - Chegg Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306.

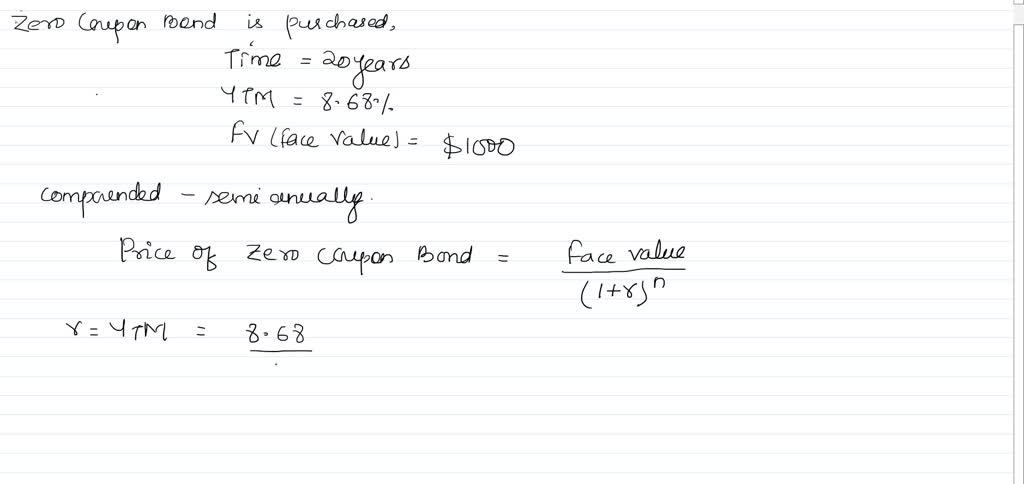

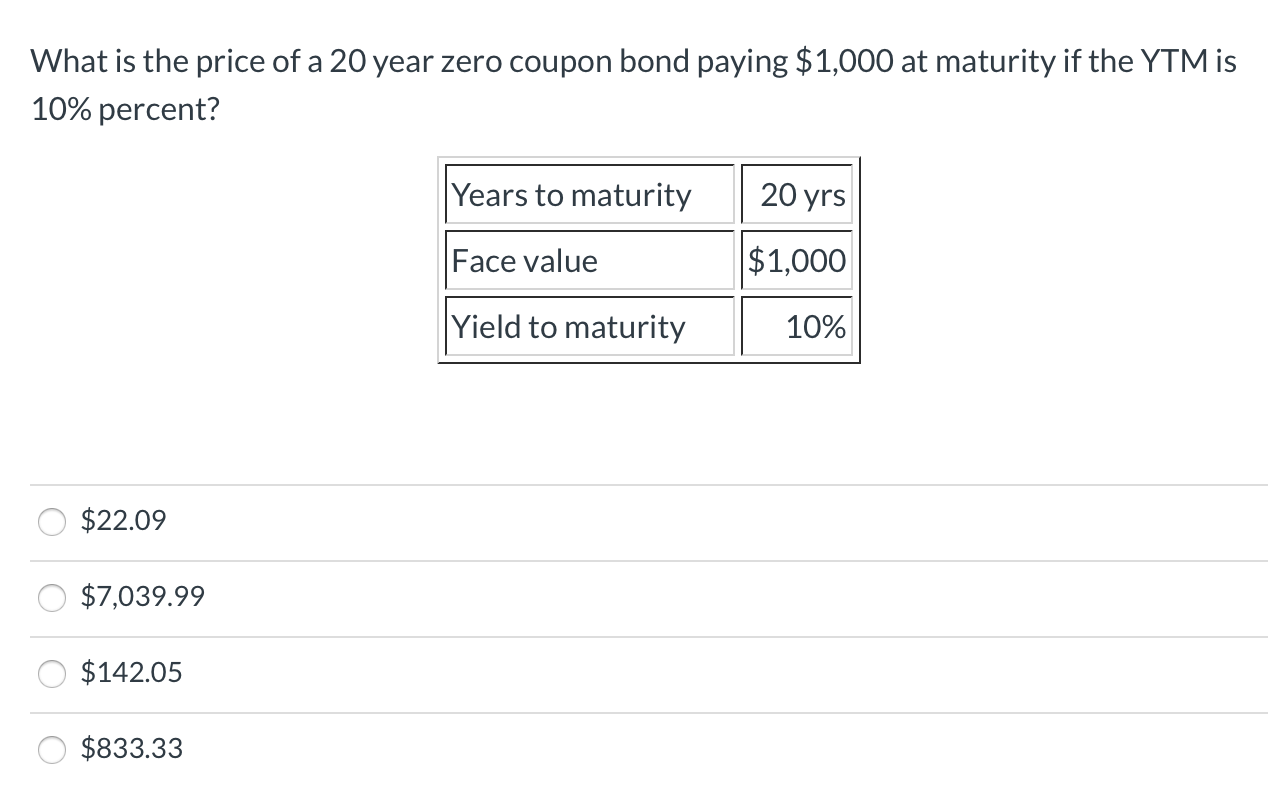

you are purchasing a 20 year zero coupon bond the yield to maturity is 868 percent and the face value is 1000 the interest rate is compounded semi annually what is the current market price a 13646

Zero Coupon Bond Definition and Example | Investing Answers If this bond matured in 20 years instead of 3, the price you pay will differ: In other words, all else equal, the greater the length until a zero coupon bond's maturity or the greater the rate of return, the less the investor will pay. ... You would pay income taxes on the $45.90 each year. Advantages of Zero Coupon Bonds.

Solved Consider a zero coupon bond with 20 years to maturity - Chegg 1) The current yield is: 2). The yield to maturity is: Please show work. Question: Consider a zero coupon bond with 20 years to maturity and $25,000 face value if the current market price is $15,000. (Use semiannual compounding in your calculations). 1) The current yield is: 2). The yield to maturity is: Please show work.

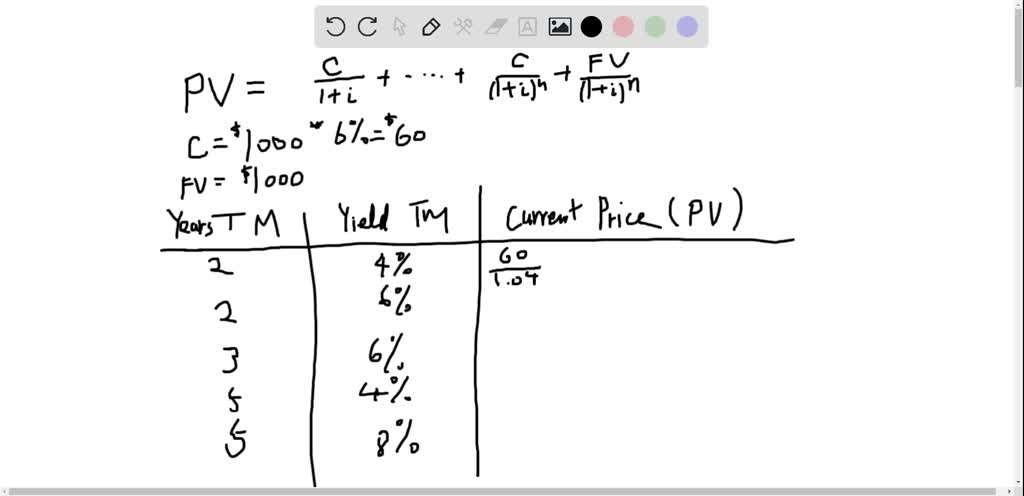

consider a bond with a 6 annual coupon and a face value of 1000 complete the following table what re

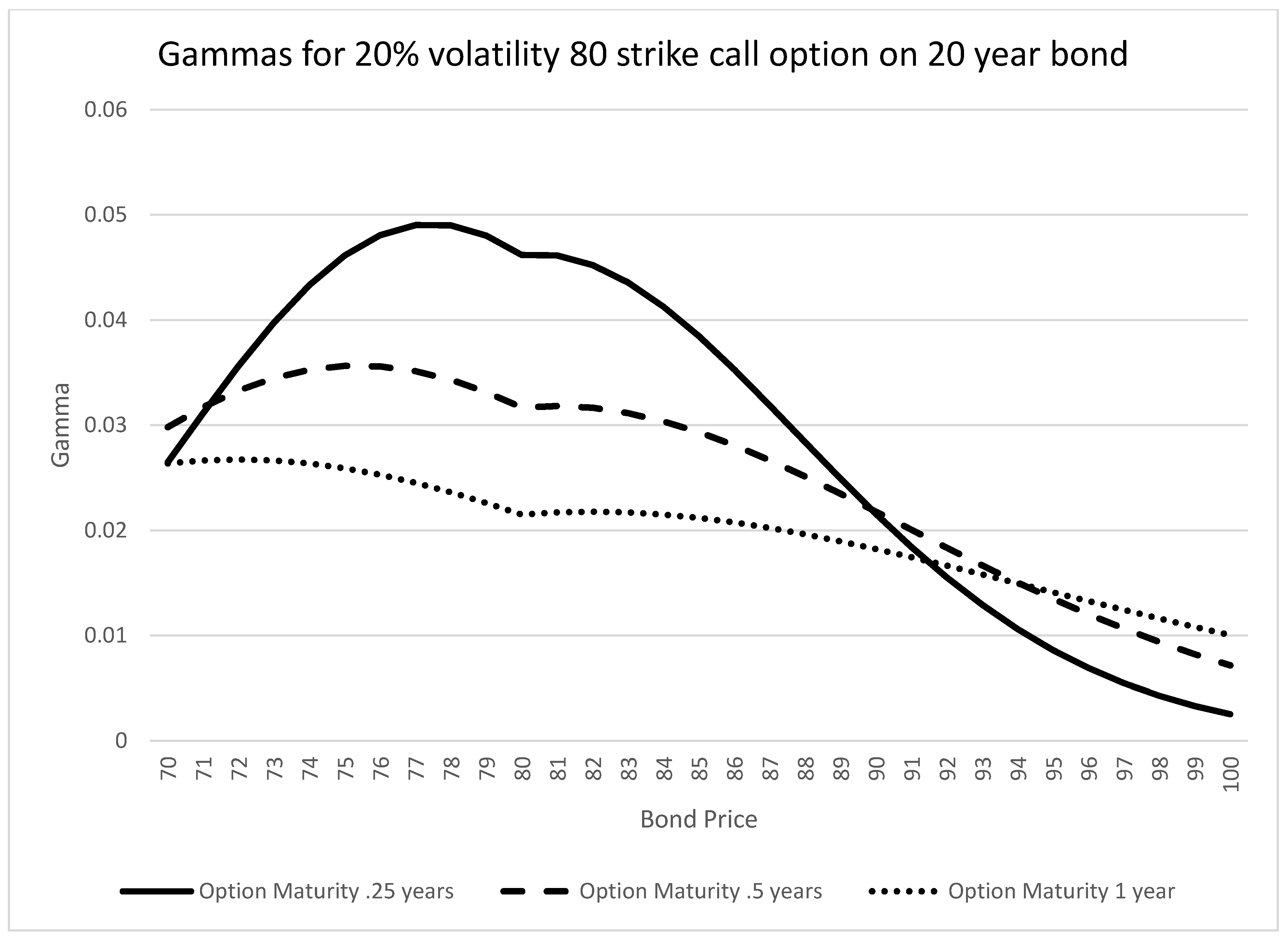

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity...

Answered: Consider a bond with a zero percent… | bartleby Business Finance Q&A Library Consider a bond with a zero percent coupon rate with 20 years to maturity and a face value of $1,000. What is the price of the bond if the yield-to-maturity is 6%?: $215 $306 $312 $335. Consider a bond with a zero percent coupon rate with 20 years to maturity and a face value of $1,000.

Solved Consider a zero coupon bond with 20 years to | Chegg.com The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to: Question 17 options: A) 38% B) Question : Consider a zero coupon bond with 20 years to maturity.

Consider a $1,000-par-value 20-year zero-coupon bond issued at a yield ... answered • expert verified Consider a $1,000-par-value 20-year zero-coupon bond issued at a yield to maturity of 10%. If you buy that bond when it is issued and continue to hold the bond as yields decline to 9%, the imputed interest income for the first year of that bond is star2371 is waiting for your help. Add your answer and earn points.

Zero-Coupon Bond Definition - Investopedia Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates to 6% interest per year. The greater the length of time until the bond matures, the less the investor pays for it, and...

Answered: Consider a zero-coupon bond with a… | bartleby Business Finance Q&A Library Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity. If the YTM of this bond is 11.2%, then the price of this bond is closest to: .... O A. $415.08 O B. $346.00 O C. $1,000.00 O D. $484.26 Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity.

Solved Consider a zero coupon bond with 20 years to - Chegg This problem has been solved! See the answer Consider a zero coupon bond with 20 years to maturity. The percentage change in the price of the bond if its yield to maturity decreases from 7% to 5% is closest to Expert Answer 100% (3 ratings) Assuming face value to be $1,000 Price at 7% = FV / (1 + r)n Price at 7% … View the full answer

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Post a Comment for "41 consider a zero coupon bond with 20 years to maturity"