41 zero coupon bond price calculation

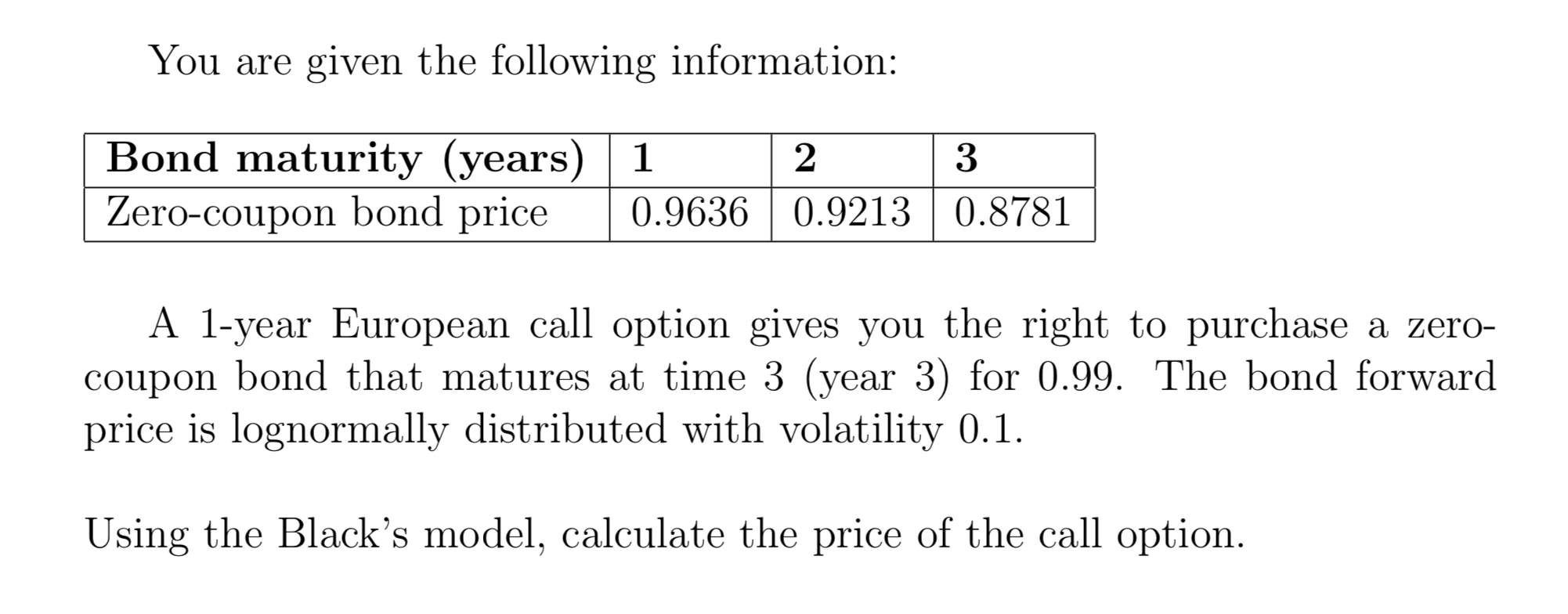

Zero Coupon Bond: Formula & Examples - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value ; Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

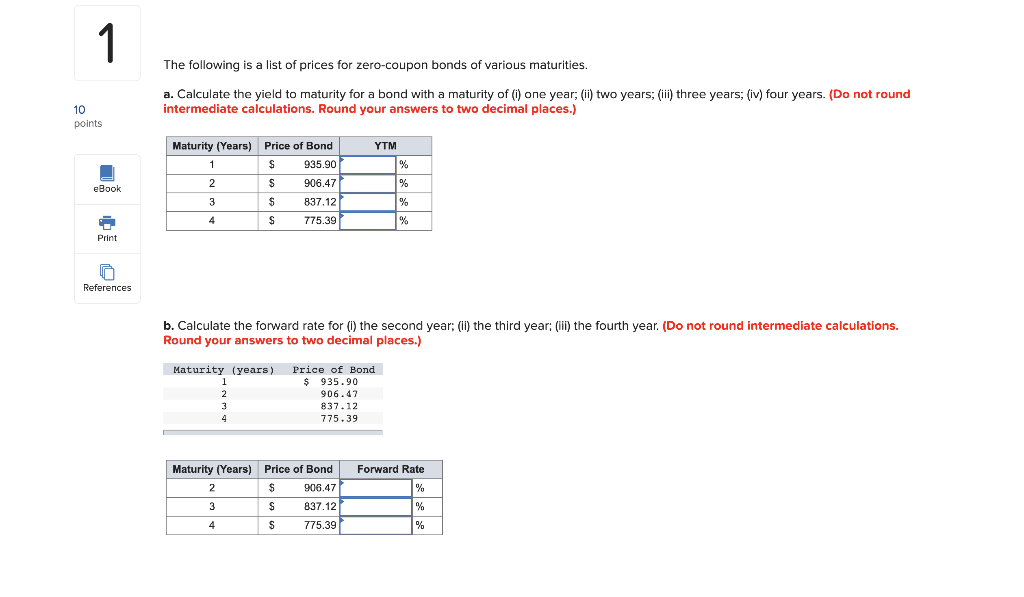

› EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3. Spreads (bp) are differences bid and offer yields.

Zero coupon bond price calculation

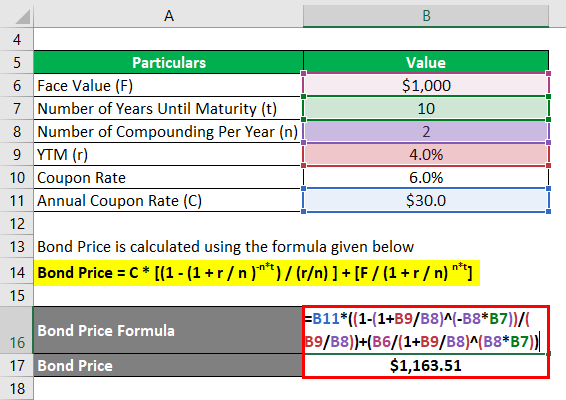

Bond Price Calculator | Formula | Chart It is normally calculated as the product of the coupon rate and the face value of the bond. What is the YTM? YTM stands for the yield to maturity of a bond. It is the rate of return bond investors will get if they hold the bond to maturity. What is face value? The face value of a bond can also be called the principal. How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Zero coupon bond price calculation. EOF › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. › terms › dDuration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =... dqydj.com › bond-convexity-calculatorBond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Calculate Price, Yield to Maturity & Imputed Interest for a Zero Coupon ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Zero Coupon Bonds: Calculating Price, Interest, and Value - BrainMass The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. The bond's duration is 3.6481 years. You expect that interest rates will fall by .3% later today. * Use the modified duration to find the approximate percentage change in the bond's price.

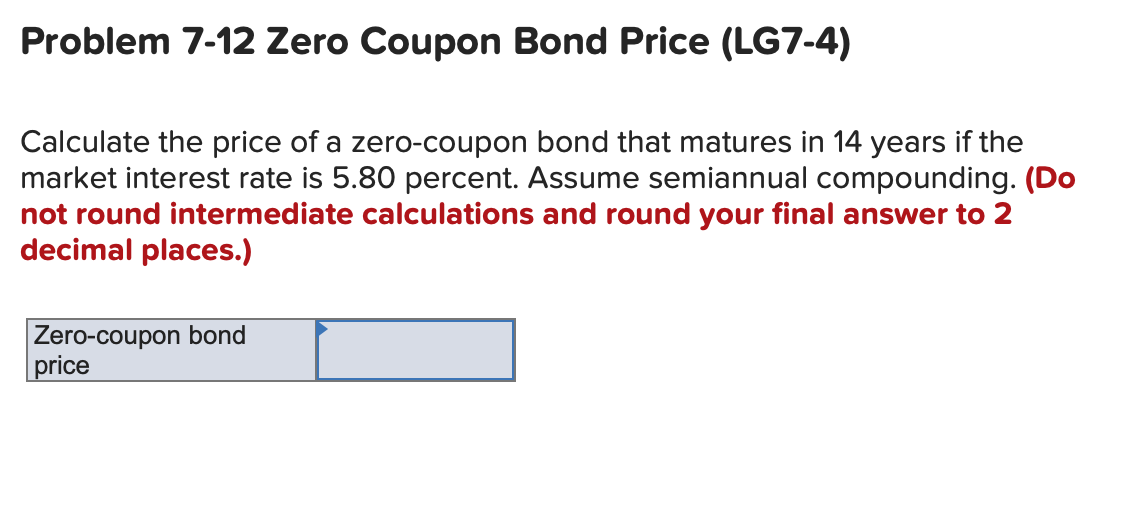

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... What Is Bond Duration? Definition, Formula & Examples Albany, GA (31701) Today. Sunshine and a few afternoon clouds. High 79F. Winds NE at 5 to 10 mph.. Zero Coupon Bond - Explained - The Business Professor, LLC Calculating the Price of a Bond. Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay ... What is a Zero Coupon Bond? - ICICIdirect Pricing of a Zero Coupon Bond . The formula used to calculate the price of zero-coupon bonds is: Price = Face Value/ (1+r)^n . Where r is the annual return, and n is the number of years until maturity. Why invest in a Zero Coupon Bond 1. Returns are predictable . The most significant advantage of a zero-coupon bond is that the returns that you ...

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Bond Pricing - Formula, How to Calculate a Bond's Price Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value Each bond must come with a par value that is repaid at maturity. Without the principal value, a bond would have no use. The principal value is to be repaid to the lender (the bond purchaser) by the borrower (the bond issuer).

Zero Coupon Bond Price Calculator Excel (5 Suitable Examples) - ExcelDemy 1. Applying Generic Formula to Create Zero Coupon Bond Price Calculator in Excel. In this method, we will use the generic formula for Zero Coupon Bond Price Calculator in Excel. We know, the generic formula for Zero Coupon Price Calculation = (Face Value)/〖(1+r)〗^t. Steps: First, we will type the following formula in cell C8.

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

ZeroCouponBond: Zero-Coupon bond pricing in RQuantLib: R Interface to ... The ZeroCouponBond function evaluates a zero-coupon plainly using discount curve. More specificly, the calculation is done by DiscountingBondEngine from QuantLib. The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For more detail, see the source code in the QuantLib file test-suite/bond.cpp .

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Zero Coupon Bond Definition Formula Examples Calculations Of 463-19- to coupon face bond Zero year between 463-19 8 maturing interest price value present and bond earned i-e- and life- 463-19- the value is its yield cu

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price.

Bond Price Calculator | Formula | Chart It is normally calculated as the product of the coupon rate and the face value of the bond. What is the YTM? YTM stands for the yield to maturity of a bond. It is the rate of return bond investors will get if they hold the bond to maturity. What is face value? The face value of a bond can also be called the principal.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 zero coupon bond price calculation"