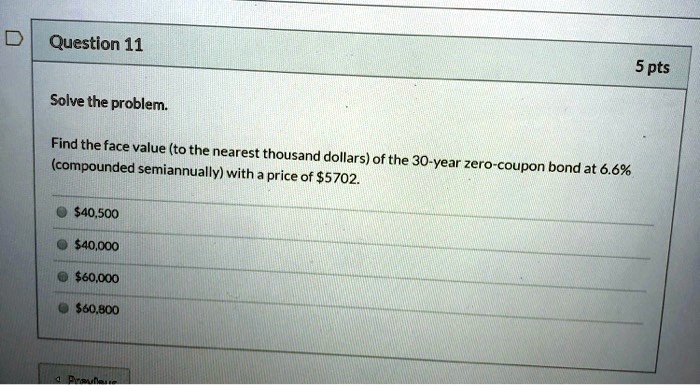

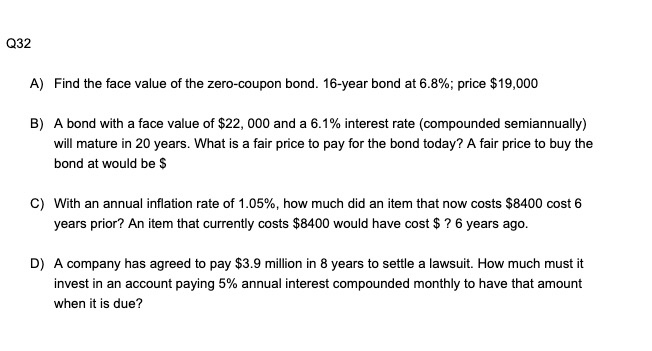

42 find the face value of the zero coupon bond

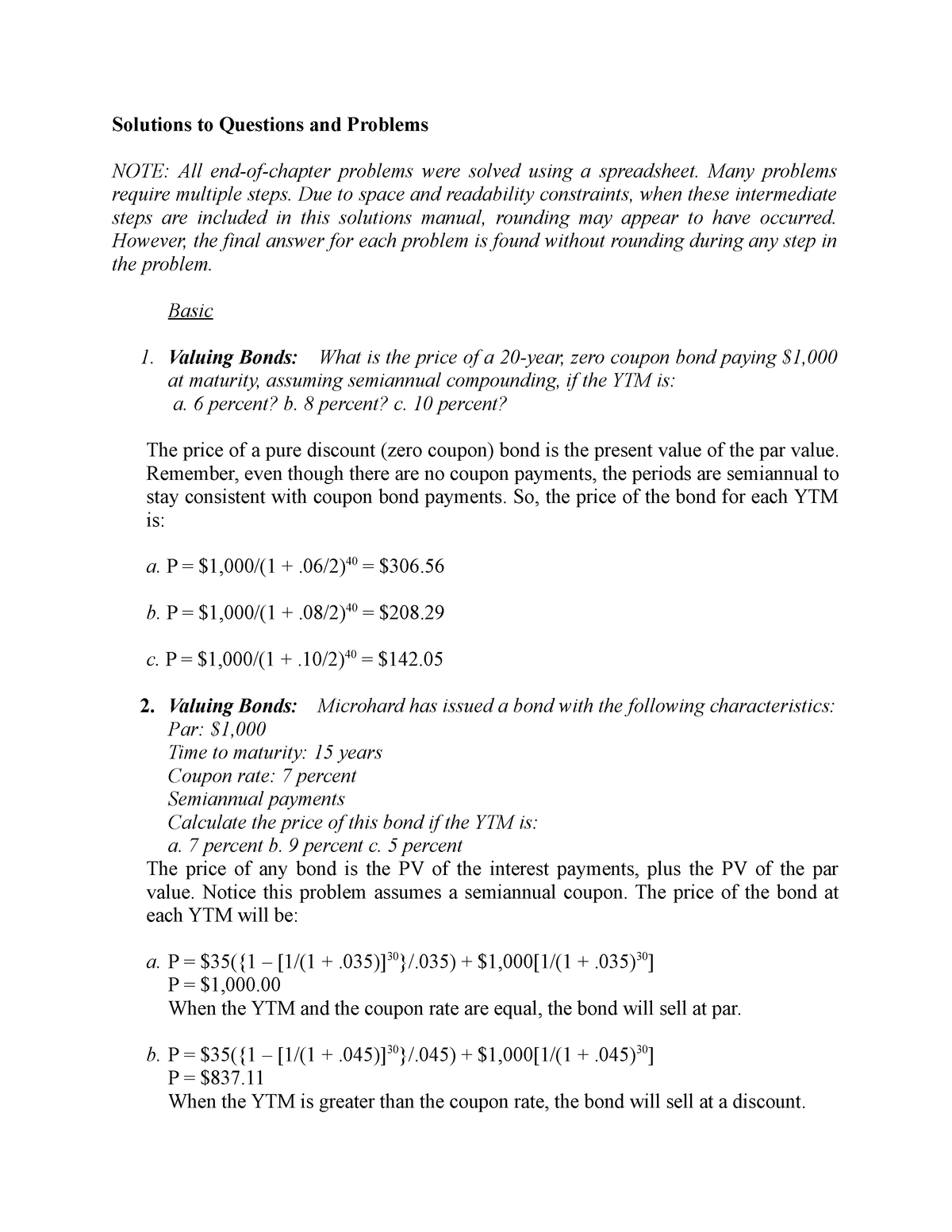

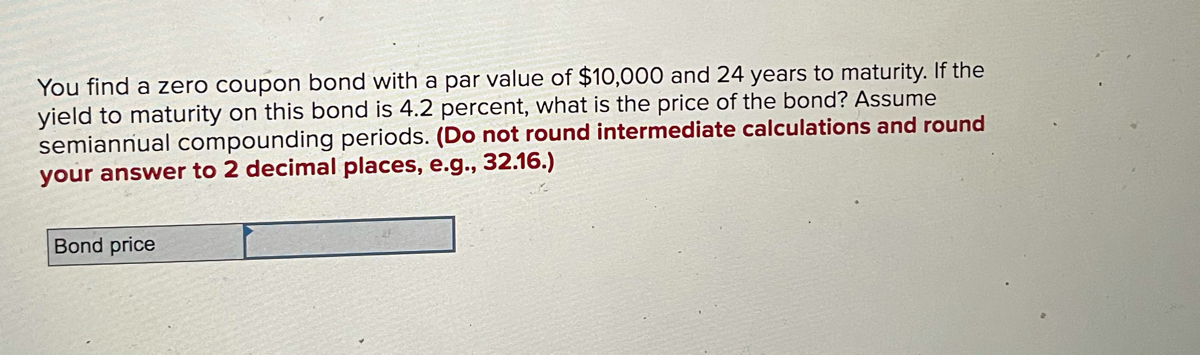

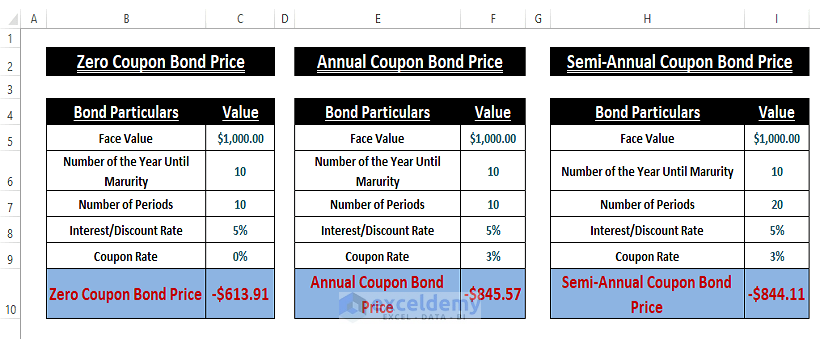

What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS... Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

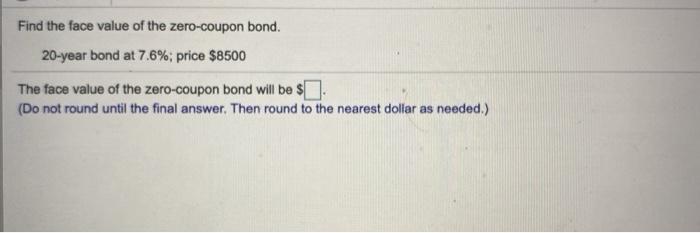

Find the face value of the zero coupon bond

Zero Coupon Bond Value Calculator Zero Coupon Bond Value = Face Value/ (1+Rate of Return/100)^Time to Maturity V = F/ (1+%RoR/100)^T This formula uses 4 Variables Variables Used Zero Coupon Bond Value - Zero Coupon Bond Value is referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments, and instead pays one lump sum at maturity. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03)20 = $553,675.75 Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

Find the face value of the zero coupon bond. Publication 537 (2021), Installment Sales | Internal Revenue ... The third-party note had an FMV equal to 60% of its face value ($30,000 ÷ $50,000), so 60% of each principal payment you receive on this note is a nontaxable return of capital. The remaining 40% is interest taxed as ordinary income. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Suppose you purchase a $1000 face value Zero-coupon bond with a ... Question. thumb_up 100%. Transcribed Image Text: QUESTION 18 Suppose you purchase a $1000 face value Zero-coupon bond with a maturity of 30 years and a yield to maturity of 4% quoted with annual compounding What is the current price of the bond? Ⓒa. $1,400.00 O b.$ 308 31 O c. $1,400.21 Od.$ 400.00 Oe.$ 311.29. IDM Members Meeting Dates 2022 | Institute Of Infectious ... Feb 16, 2022 · IDM Members' meetings for 2022 will be held from 12h45 to 14h30.A zoom link or venue to be sent out before the time.. Wednesday 16 February; Wednesday 11 May; Wednesday 10 August

Zero Coupon Bond Value Calculator How to calculate Zero Coupon Bond Value using this online calculator? To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 0.000102 = 1000/(1+4)^10. What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date. Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds.

Zero Coupon Bond Value Calculator - Find Formula, Example & more Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. U.S. News | Latest National News, Videos & Photos - ABC News ... Oct 28, 2022 · Get the latest breaking news across the U.S. on ABCNews.com Bonds and their Types - eFinanceManagement Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. A zero coupon bond with a face value of 1000 is issued with an initial ... 64) Khanijow's wants to raise $12.4 million to expand its business. To accomplish this, it plans to sell 25-year, $1,000 face value, zero-coupon bonds. The bonds will be priced to yield 6.5 percent, with semiannual compounding. What is the minimum number of bonds the firm must sell to raise the $12.4 million it needs? A) 59,864 B) 52,667 C) 61,366 D) 60,107 E) 60,435

CFPB Issues Guidance to Help Banks Avoid Charging Illegal ... Oct 26, 2022 · “Americans are willing to pay for legitimate services at a competitive price, but are frustrated when they are hit with junk fees for unexpected or unwanted services that have no value to them,” said CFPB Director Rohit Chopra.

Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM.

Solved Find the face value of the zero-coupon bond. 15-year | Chegg.com Find the face value of the zero-coupon bond. 15-year bond at 3.3%; price $3000 The face value will be $. (Do not round until the final answer. Then round to the nearest dollar as needed.) A six-month $4800 treasury bill sold for $4562. What was the simple annual discount rate? The discount rate was %.

Find the face value of the zero-coupon bond. 12 -year | Chegg.com Expert Answer. Transcribed image text: Find the face value of the zero-coupon bond. 12 -year bond at 5.2%; price $15,000 The face value will be \$ (Do not round until the final answer. Then round to the nearest dollar as needed.)

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond =...

Home | NextAdvisor with TIME Today Is the Last Day to Lock in a 9.62% I Bond Rate. We Answer Your Questions 7 min read. You Can Earn 3.00% with a Capital One Savings Account. How to Maximize Higher Interest Rates

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Answered: Find the face value of the zero coupon… | bartleby Solution for Find the face value of the zero coupon bond 20 year bond at 5.67% price $9400

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww In earlier days, companies used to raise funds from investors based on a written guarantee. This written guarantee is known as a bond. Coupon bonds provide coupons or interests at regular intervals. Zero-Coupon Bonds, as the name suggests, do not provide any coupon or interest during the tenure but repay the face value at the time of maturity.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03)20 = $553,675.75 Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions:

Zero Coupon Bond Value Calculator Zero Coupon Bond Value = Face Value/ (1+Rate of Return/100)^Time to Maturity V = F/ (1+%RoR/100)^T This formula uses 4 Variables Variables Used Zero Coupon Bond Value - Zero Coupon Bond Value is referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments, and instead pays one lump sum at maturity.

Post a Comment for "42 find the face value of the zero coupon bond"